Cash Advance industry

The Cash Advance industry is one of the fastest-growing industries in the nation. Thousands of people all over the country are participating in non-secured short-term loans. For many, the online cash advance is a solution to their temporary cash flow problems. Unfortunately for others. Payday loans are not the answer.

Borrowers who don’t find out the terms of a cash advance, or who don’t make the repayment. Or who don’t have a long-term budgeting strategy, are the ones who don’t benefit the most from this type of loan. It can’t be stressed enough, that an online cash advance is for individuals who are strapped for cash between paychecks. And need a short-term advance for an emergency situation. A short term loan is meant to be paid pack upon deposit of your next paycheck.

Short term loans

Short term loans have advantages for borrowers in an emergency cash situation. Because the loans are short term, and the borrower agrees to repay with next paycheck, the requirements for qualifying for the loan are much less stringent. Standard rules of lending depend on information presented in the borrower’s credit history, for example. With an online cash advance, the creditor usually won’t check the prior credit history.

So, for those with poor credit history facing a cash crisis, a cash advance may be a viable option. Even though you may be working on clearing up your credit history. Your past credit mistakes may still be holding you back. An online cash advance may provide emergency cash for you while you’re on the road to a better credit rating. You have access to relief from unexpected bills, and budgeting is easy because repayment is done at the time of your next paycheck.

Credit history

If your credit history is bad, and you’ve been unable to get credit cards, then you already know that traditional lending methods aren’t available to you. A poor credit history can follow you and make it more difficult or more expensive to enter into lots of the everyday financial relationships you encounter in life.

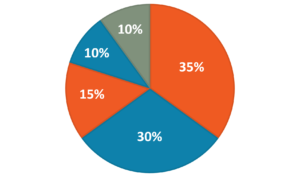

You might have seen higher rates, added fees, and flat-out rejection because of your bad credit. You know that any kind of loan and cash advance industry, whether it is a traditional loan from a bank or a short-term cash advance. Is going to cost you more because of your bad credit. An online cash advance charges a fee for the loan. Which is a percentage based on the amount of the loan. You’ll know exactly how much your fee is going to be, after talking to a representative from the lender. There are no surprises here.

Doubts?

If you have doubts about how much your cash advance is going to cost you in fees, you have the opportunity to ask the rep, who will call you after your submit cash advance industry your application online. You will be able to compare the fee with the fees attached to other lending options you might have at the time. Compared to other options. The fee may seem reasonable. Cash advance industry do offer privacy and speed over traditional methods of lending.